FIRE Calculators Frustrate Me, So I Built My Own

Most FIRE discussions mis-represent the future value of today’s dollars. I’m sharing my spreadsheet so you can avoid it.

I stumbled into the Financial Independence, Retire Early (FIRE) world about nine years ago, right as we were planning our move back east from a short stint in Silicon Valley. Fortuitously (and out of necessity, since we had very little saved), we bought a house from across the country that cost roughly one year’s salary. We still live in that house today, and for the last eight years, we’ve been shoveling extra cash into rental properties and stocks.

After a few years of figuring things out, we sat down to make a plan: CoastFIRE through real estate. Simple enough. But then life happened:

2020 (COVID): my whole perspective on what matters shifted.

End of 2020 (startup acquisition): we hit our number five years early.

2021 (my own bet on myself): I failed financially, hard.

So here we are. Still fine, but with more work to do to reach the lifestyle-adjusted version of FIRE we actually want.

Late last year, I sat down to do some deeper-dive planning. I wanted to know: What do we really need to live on? After running the numbers, we landed on $120k per year: comfortable, not extravagant. Enough to cover life, with some buffer for travel, investing, and the inevitable surprises.

We had our annual expenses figured out, but now we needed to figure out how much we’d need invested to be able to spend it. I’ve been aware of the concept of a 4% safe withdrawal rate (SWR, though recently revised up to 5% by the creator) for some time now, so I started with that goal in mind.

But here’s where I got frustrated: most FIRE calculators ignore the future value of money. They talk about hitting $X in 10 or 20 years like today’s dollars magically stretch as much. That’s not how it works. Inflation eats at everything. So I built a spreadsheet that actually accounts for the moving pieces. And I’m sharing it with you for free.

Before you grab the spreadsheet, though, it’s definitely worthwhile to know how to use it. Here are the key pieces you’ll need to understand.

1. Know Your “If I Retired Today” Expenses

You probably have a handle on your expenses already. If not, start there. Then ask: What would change if I walked away tomorrow?

Work costs gone (commutes, daycare, lunches out).

Lifestyle shifts (maybe more dinners out with family, more travel).

Debts that eventually disappear (mortgage, renovation loans, student loans).

We picked $120k/year because it’s above our current budget ($92k in 2025) but leaves room for growth (more travel, keep investing) and unknowns (lump-sum costs, healthcare).

2. Don’t Ignore Inflation

Over 50 years, U.S. inflation has averaged ~3.8% annually1. Sometimes lower, sometimes higher, but it compounds. So instead of assuming $120k means the same in 20 years, I modeled what that money would actually buy as time goes on.

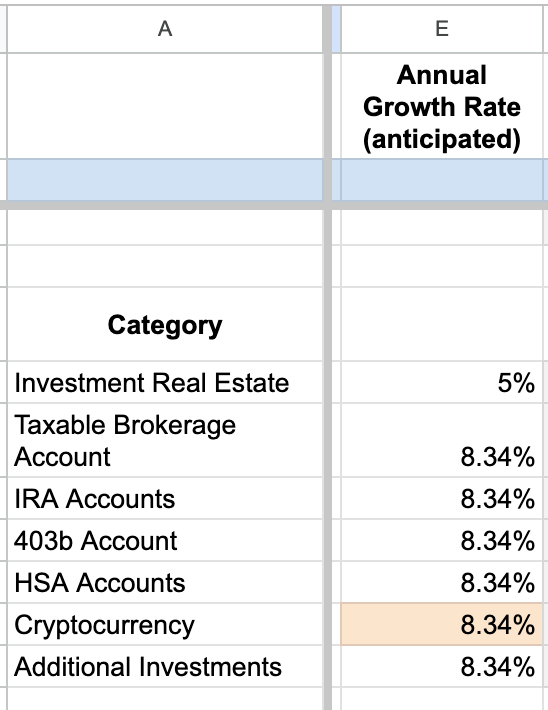

3. Track and Model Investments Honestly

If you’re a Boglehead or otherwise have a simple asset allocation, you can lean on historical averages.

If you’re like us—a mix of real estate, stocks, and a little crypto—you need to break it out by asset class. Otherwise, you’ll be fooling yourself about how your assets might grow.

Important: Start with taking stock (no pun intended) of what you already have in each class, since this is the base you’ll build on!

4. Grok Usable vs. Non-Usable Net Worth

Your house? Not usable if you’re planning to live in it. Same for cars or land you don’t intend to sell. Count only what’s actually working toward financial independence (FI).

5. Model Your Future Contributions

Unless you’re already FI (or want to work longer than necessary [see point #8 below]), you’ll need to invest more to speed things up.

More uncertainty comes as you go farther away from today, so unless you have some very clear known windfall, focus on dialing in the near-term numbers.

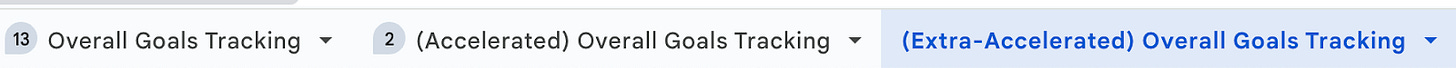

Got some uncertain life events (i.e. startup acquisitions, illiquid investment returns, inheritances) coming up? Build those out as different scenarios in different spreadsheet tabs.

In 2024, we thought we could scrape together $20k in 2025, then $40k/year from 2026 on. Manageable, if a little tight, since I took a relatively low-paying job in 2024.

Then a surprise hit: I accepted a new role that nearly doubled my comp. Thanks to a solid 401k match and 15 years of living below our means, we revised our plan: $30k in 2025, then a whopping $140k2 annually from 2026 forward.

Life rarely goes to plan, but sometimes it surprises you in the best way.

6. Appreciate the Snowball (DRIP)

Some of our investments throw off dividends (about 1% annually), and yours may too. It’s not a lot at first, but each year the portfolio grows, reinvesting those dividends makes hitting annual goals easier.

Some of our other investments are more…lumpy. We’re in a local real estate syndication that averages 5% dividends, though we’ve had worse years and will (hopefully) have much better ones. Since those returns are all over the place, we assume the average and will be pleasantly surprised when (if?) it outperforms.

7. Find Your CoastFIRE and Full FIRE Dates

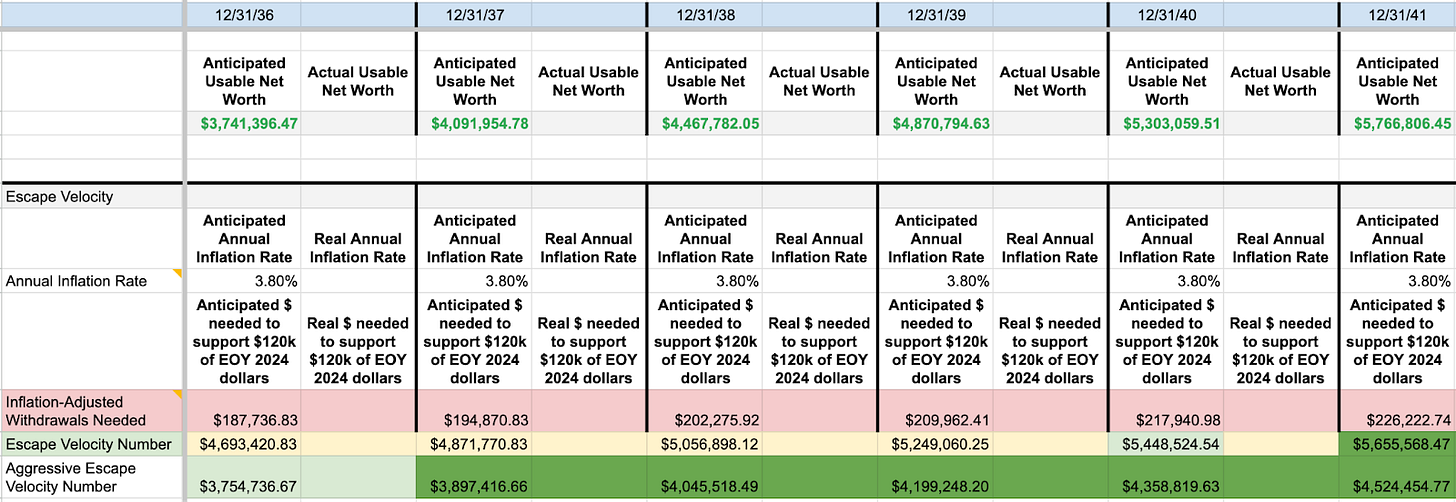

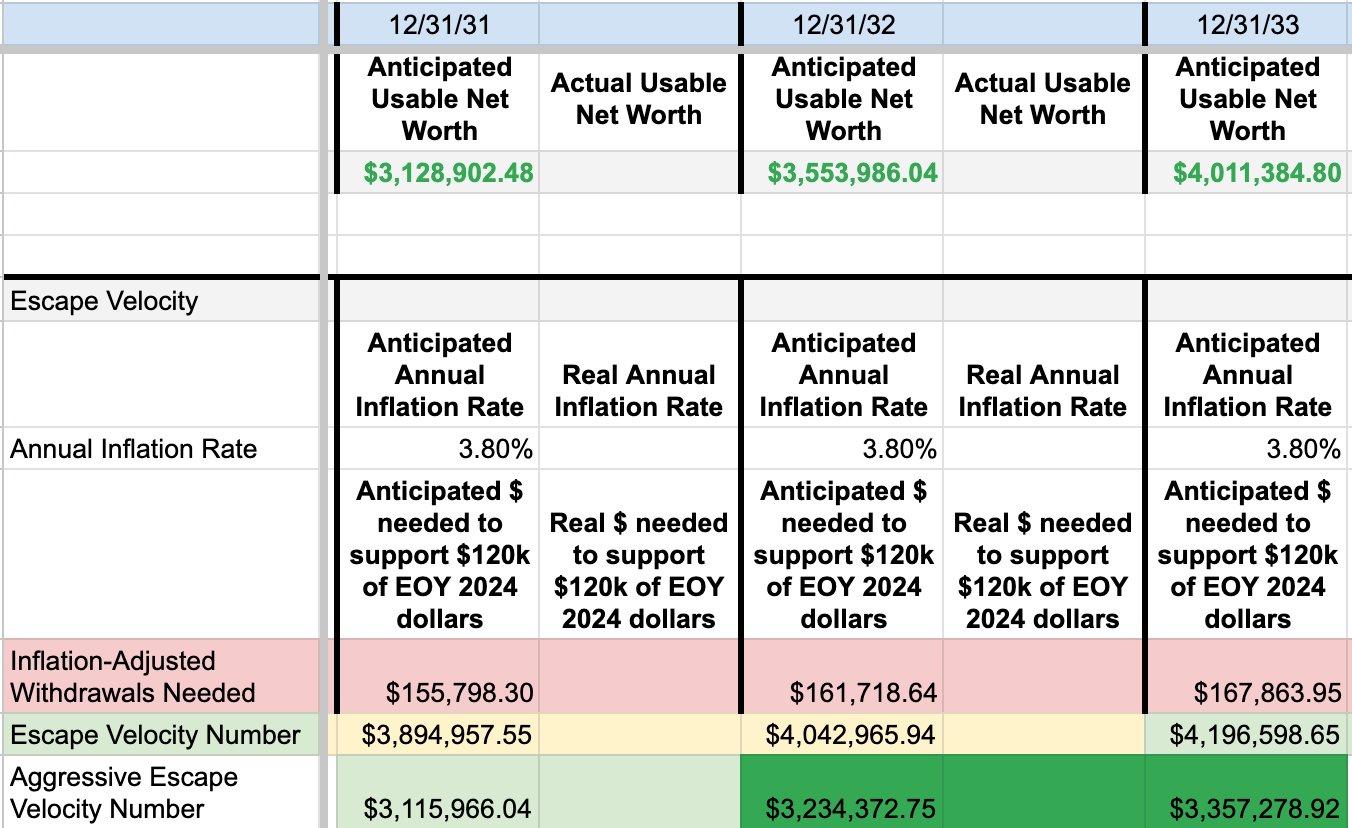

Once you have a model of your expected expenses (in today’s dollars), know your current investments, and have a projection of your annual investment contributions, it’s time for the fun part: figuring out when you’ll hit Escape Velocity (a.k.a. “F You Money”).

For us, the math looks like this:

20x $120k = $2.4M (aggressive 5% SWR)

25x $120k = $3M (traditional 4% SWR)

But remember, this is only our Escape Velocity if we retired at the end of 2024. Inflation’s a b****, so our expenses (using average inflation) is already up to ~$125k if we retire in 2025! It’ll just keep increasing from there, which is why I built my spreadsheet to calculate the right numbers every year.

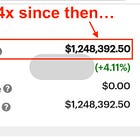

Our usable net worth today? Between $1.2 and $1.4M (depending on how our residential real estate divestment goes). At our old contribution rate, full FIRE was somewhere between 2036 and 2041.

At our revised rate? 2031–2033.

The wildest part? Most of the heavy lifting comes from the money we already invested. The new contributions move the finish line closer by 5-8 years, but compounding is really what carries the day.

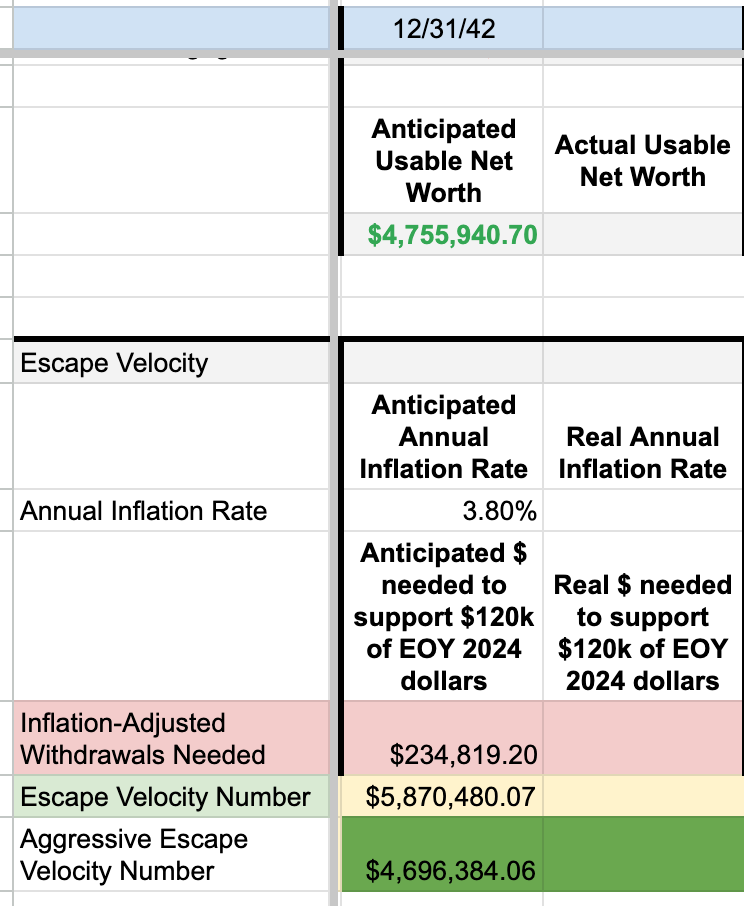

Just for grins, I decided to create one more scenario (no investment beyond 2025). Even still, our aggressive (5% SWR) date is only sometime in 2042. That means that if we want to fully retire at 53 (me) and 51 (partner), we just have to let our investments grow across the next 17 years.

8. Define What FIRE Looks Like to You

Hitting a number doesn’t automatically mean quitting. For some, it’s a chance to slow down. For others, it’s the freedom to bet on themselves in new ways.

A friend of mine is on track to be FI in Silicon Valley by 40, even with an insane Bay Area mortgage and two kids. But instead of walking away, they want to consult in their field. Recently they told me that when I founded a bootstrapped startup in 2021, they really wished they could do the same, but getting to FI was a higher priority. As one of my smartest and most driven friends, I’m excited for what’s ahead for them!

And really, that’s the allure of FIRE to me: not retiring early, but the options it unlocks.

The Goods

As I promised at the beginning, here’s the spreadsheet I created that makes it really easy to calculate this for yourself. You can grab it here for free (and if you find it helpful, I’d love it if you subscribed) and change the dummy numbers to match your situation.

Your Turn

Do you know your FI number? Is it close, or does it still feel a lifetime away?

Based on annual values from https://data.bls.gov/timeseries/CUUR0000SA0L1E?output_view=pct_12mths, adjusted to range 1975-2024

As someone who’s virtually never earned my actual market wage, I know how privileged I am to finally be in this position.